Hanging noodles are dry noodles made by adding natural raw materials to wheat flour and then hanging and drying them. The main varieties include ordinary hanging noodles, colorful hanging noodles, handmade hanging noodles, etc; According to the variety of ingredients, there are egg noodles, tomato noodles, spinach noodles, carrot noodles, kelp noodles, lysine noodles, etc. At present, there are various types of noodles on the market, such as staple food, flavor type, nutritional type, and health type, which are popular among people.

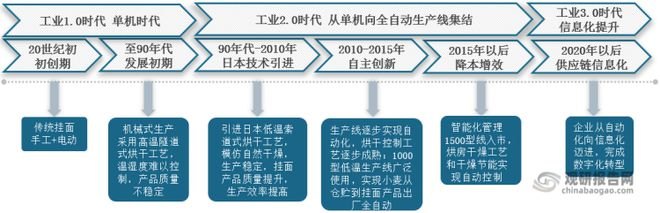

1. Development History

The development process of China's noodle industry is mainly divided into three stages: the era of single machines, the transition from single machines to fully automated production lines, and the advancement of automation to informatization. At the beginning of the 20th century, the noodle industry was in its infancy, producing traditional noodles in manual and electric forms; In the 1990s, noodles were produced mechanically, but the product quality was unstable; Subsequently, after introducing the low-temperature cableway drying system from Japan, the production efficiency and quality of dried noodles were greatly improved. After 2010, with the continuous improvement of noodle production equipment, the process technology gradually matured and fully automated production of noodle products was achieved. In 2020, hanging noodles enterprises will carry out the strategic Digital transformation stage, and make comprehensive progress towards informatization; On the one hand, it effectively reduces costs and increases efficiency, and on the other hand, it lays out multiple categories, and the noodle industry has entered a relatively mature period.

The Development History of China's Noodle Industry

Source: Deep Research on the Current Situation and Development Prospects of China's Noodle Industry (2022-2029)

2. Yield

China is the world's largest producer of noodles. From 2017 to 2020, the domestic production of noodles steadily increased from 7.81 million tons to 8.88 million tons, with a compound annual growth rate of 4.4%. The growth rate of domestic noodle production continued to slow down from 2017 to 2019, but in 2020, benefiting from the epidemic, the growth rate of noodle production increased to 5.8%. Against the backdrop of the normalization of the epidemic, the market for noodle production and demand is gradually saturated, resulting in overcapacity. In 2021, the industry reduced noodle production to 7.11 million tons, an increase of -19.9% year-on-year.

Data source: Deep Research on the Current Situation and Development Prospects of China's Noodle Industry (2022-2029)

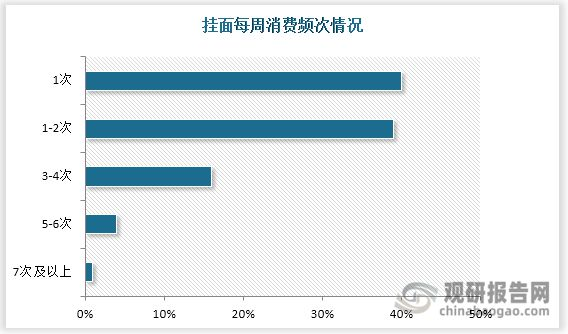

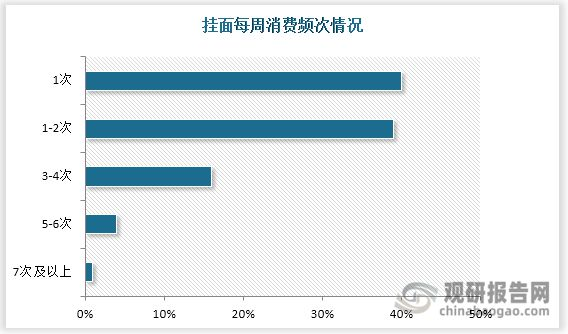

3. Consumption

Similarly, China is also a major consumer of noodles, with a broad consumer base. According to data, the weekly consumption frequency of noodles in China is mainly within 2 times, accounting for up to 80%. In this situation, the noodle market has considerable consumption capacity.

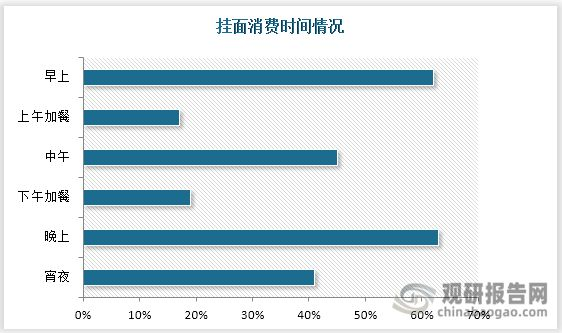

Compared to staple foods such as rice and flour, hanging noodles are more convenient to make and purchased more frequently than general fast moving consumer goods, making them a mid frequency repeat purchase product. Consumers consume more noodles in the morning and evening, and prefer the taste and cost-effectiveness of noodles.

Data source: Deep Research on the Current Situation and Development Prospects of China's Noodle Industry (2022-2029)

Data source: Deep Research on the Current Situation and Development Prospects of China's Noodle Industry (2022-2029)

4. Enterprise

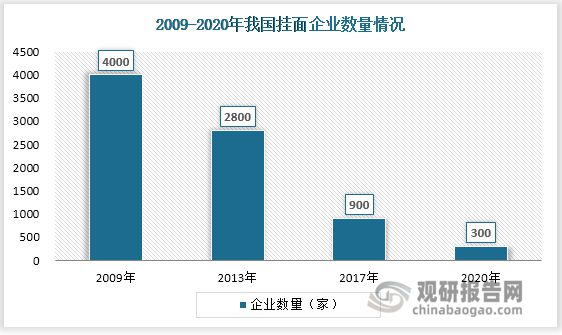

In the early stages of the development of the noodle industry, the market entry threshold was low, and the homogenization of enterprises was severe and numerous. In 2009, the number of domestic noodle enterprises reached 4000. With the increasingly fierce competition in the industry reaching a white-hot stage, small and medium-sized enterprises without obvious brand, channel, and cost advantages are gradually being eliminated from the market. In 2017, the number of listed enterprises sharply decreased to 900, and in 2020, the number of enterprises further decreased to about 300.

数据来源:中国挂面行业现状深度研究与发展前景预测报告(2022-2029年)

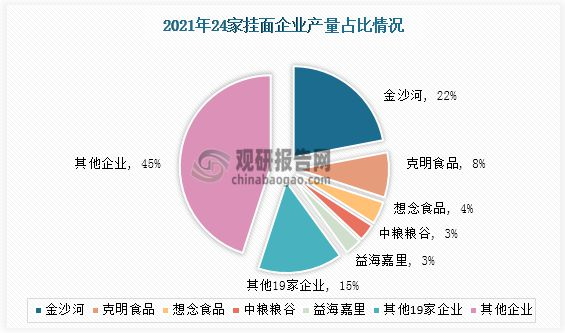

在挂面行业集中度方面,2021年CR5为40%,较上年提升了8%,不过仍有较大的发展空间。与方便面CR5接近80%的市场集中度相比,挂面行业集中度处于较低水平。随着挂面行业的整合调整,龙头企业将逐步占据已被出清的中小型企业市场份额,市场份额有望向头部企业进一步集中。

Data source: Deep Research on the Current Situation and Development Prospects of China's Noodle Industry (2022-2029)

From the production structure of the 24 standardized noodle companies in China, the total market share of the 24 companies in the industry in 2021 is 55%; The leading enterprise Jinshahe has a market share of 22%; Keming Food, Miss Food, COFCO Grain and Grain, and Yihai Jiali account for 8%, 4%, 3%, and 3% respectively

Data source: Deep Research on the Current Situation and Development Prospects of China's Noodle Industry (2022-2029)

In 2010, the total output of 24 standardized noodle companies in China was 1.7855 million tons, with a sales revenue of 6.269 billion yuan; By 2020, its production and sales have increased to 4.2527 million tons and 19.016 billion yuan respectively, an increase of 7.08% and 6.41% year-on-year compared to 2019. As of 2021, the production volume of 24 companies' noodles decreased by 1.26% compared to the previous year, to 4.1992 million tons, while sales increased slightly by 1.08% compared to the previous year, to 192.21%. From 2010 to 2021, the average annual compound growth rate of 24 noodle companies' production was 8.10%, and the average annual compound growth rate of sales reached 10.72%. The overall development trend of China's noodle industry is at a high speed.

Production and sales of 24 noodle companies

Data source: Deep Research on the Current Situation and Development Prospects of China's Noodle Industry (2022-2029)

5. Industry entry barriers

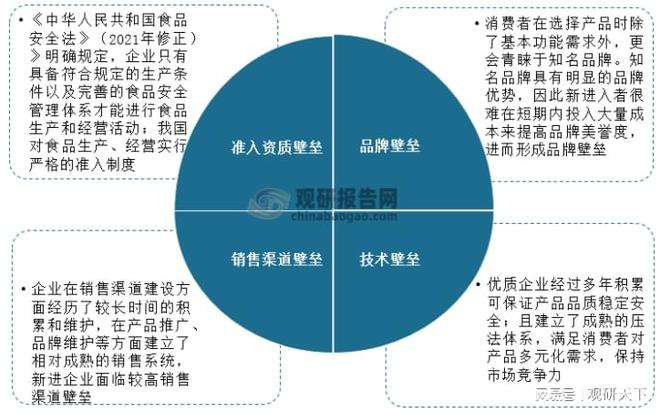

Hangmian belongs to a major category in the food industry. After several years of development, the industry still faces entry barriers such as qualifications, brands, sales channels, and technology.

Barriers to entry in China's noodle industry

Source: Deep Research on the Current Situation and Development Prospects of China's Noodle Industry (2022-2029)

The in-depth research on the current situation of China's noodle industry and the forecast report on its development prospects (2022-2029) released by Guanyan Report Network covers the latest industry data, market hot spots, policy planning, Competitive intelligence, market prospects, investment strategies, etc. Moreover, a large number of intuitive charts are used to help enterprises in this industry accurately grasp the industry's development trend, market business opportunities, and correctly formulate their competitive and investment strategies. Based on authoritative data released by the National Bureau of Statistics, the General Administration of Customs, the State Information Center of China and other channels, and combined with the environment of the industry, this report conducts market research and analysis from the perspectives of theory, practice, macro and micro.

Industry reports are one of the important decision-making bases for industry enterprises, relevant investment companies, and government departments to accurately grasp industry development trends, understand the competitive landscape of the industry, avoid operational and investment risks, and make correct competitive and investment strategic decisions. This report is an essential tool for comprehensively understanding the industry and investing in it. Guanyantianxia is a well-known industry information consulting agency in China, with a senior team of experts. Over the years, it has provided professional industry analysis reports to tens of thousands of enterprises, consulting institutions, financial institutions, industry associations, individual investors, etc. Its clients include leading domestic and international enterprises such as Huawei, PetroChina, China Telecom, China Construction, HP, Disney, and have been widely recognized by customers.

The data in this research report mainly adopts databases such as national statistical data, General Administration of Customs, questionnaire survey data, and data collected by the Ministry of Commerce. Among them, macroeconomic data mainly comes from the National Bureau of Statistics, some industry statistical data mainly comes from the National Bureau of Statistics and market research data, enterprise data mainly comes from the National Bureau of Statistics scale enterprise statistical database and stock exchanges, and price data mainly comes from various market monitoring databases. The industry analysis methods used in this research report include Porter's five forces model analysis, SWOT analysis, and PEST analysis analysis, which conduct a comprehensive analysis of the internal and external environment of the industry. At the same time, senior analysts analyze the trend of the current national economic situation, market development trends, and current industry hotspots, and predict the future development direction, emerging hotspots, market space, technology trends, and future development strategies of the industry.